Gervais Williams and Martin Turner, managers of the Miton UK MicroCap Trust, look at the reasons behind the Great British Sell-Off and whether it provides an opportunity for micro-companies.

For information purposes only. Any views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Investing involves risk. The value of an investment can go down as well as up which means that you could get back less than you originally invested when you come to sell your investment. The value of your investment might not keep up with any rise in the cost of living.

Premier Miton is unable to provide investment, tax or financial planning advice. We recommend that you discuss any investment decisions with a financial adviser.

The effect of the US giants

Whilst the rise in global stock markets became quite widespread in the final part of 2023, in the early part of 2024, US mega companies’ outperformance has become the dominant theme again. US Gross Domestic Product (GDP) accelerated in the final quarter as a result of extra spending under the terms of the Inflation Reduction Act – legislation designed to encourage investment in green energy – funded by an increase in US government borrowing. The net effect was that US company results typically outpaced expectations, with Nvidia’s share price in particular rising dramatically.

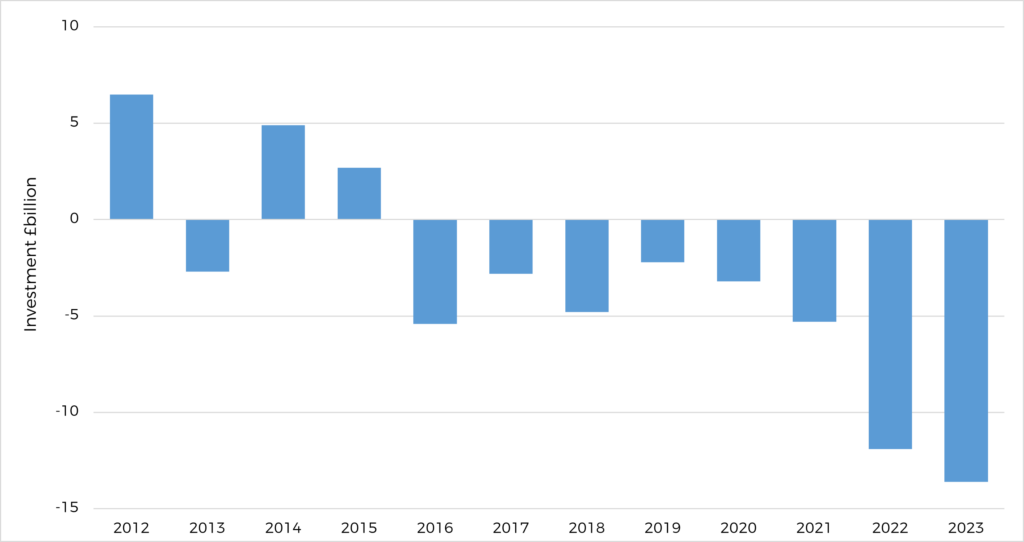

US stock market outperformance continues to weigh on the valuation of the UK stock market. During the globalisation decades, the low-beta nature of the UK market has led to its return and its valuation lagging other markets. (Beta is a measure of how the price of a particular investment or group of investments moves in relation to the wider stock market). Overseas investors withdrew capital, so they could participate in superior returns elsewhere. As the returns on the seven large US mega-companies – the so-called “Magnificent Seven” – have accelerated upwards over recent years, UK investors have also reduced their holdings in UK funds, which the chart below highlights.

Annual investment into UK Equity Funds

Source: Numis research

What has this meant for UK companies, particularly micro-companies?

This adverse trend has weighed most heavily on UK small and micro-companies listed on the UK stock exchange (UK stocks). Whilst UK investor selling of UK stocks may have accelerated, many large companies have been able to generate surplus cash (cash that exceeds the required for day-to-day operations), some of which they have been able to deploy to buy back their own shares, counterbalancing this selling pressure. As a result, the return from the FTSE 100 Index has largely kept pace with other global stock markets. UK small and micro-companies are more likely to be focused on investing for the future, so do not have the same levels of surplus cash available to buy back their shares.

What do we expect from here?

The current global economic outlook is mixed. Whilst elevated interest rates have dampened global demand, in the US this has been offset by measures to encourage growth. In the first half of 2023, actions by the Federal Reserve Bank to help address the growing issue of near-insolvency amongst a number of regional banks were followed by the implementation of the Inflation Reduction Act. As the effects of this started to take hold in the US in late 2023, higher interest rates without extra stimulus led to weakening economies in Europe and Asia.

Headwinds for 2024

While many stock markets may have risen over 2023, the headwinds for 2024 look more challenging. There is little economic momentum in Europe or Asia, suggesting that even with major interest rate cuts, these economies appear set to weaken further in the near term, as the effects of cuts will take time to feed through to the wider economy. Meanwhile, a higher level of US government borrowing may help boost that economy, but it comes with additional bond issuance that may absorb investors’ cash.

Given current US economic growth, US mega-company share prices have started 2024 well. But the longer that global interest rates remain elevated, the greater the dampening impact this will have on general levels of demand. When demand falls below supply, customers have pricing power and company profit margins become vulnerable. This has already been seen with the prices of electronic goods and cars coming under downward pressure. In time, we can expect a similar trend in the service sectors, which importantly comprise a much larger part of the global economy.

A particular opportunity for micro-caps…

This will be a challenge for all businesses, both large and small, but larger companies are potentially more vulnerable. When demand weakens, large companies can struggle to pick up additional sales elsewhere, at a rate fast enough to offset that declining demand. In contrast, whilst some micro-companies may suffer, their immaturity means that those with resilient business models have a greater chance of keeping their businesses moving forward.

If the global downturn were to be more severe than expected, then listed micro-companies with relatively strong balance sheets and the potential to raise additional funding might have an even greater chance of bucking the trend, by investing in their businesses at a time when others are constrained. This can generate greater returns which may be transformational to listed micro-companies earnings and share prices.

…as UK prospects start to improve

Meanwhile, the prospects for UK investors may in fact be improving. January’s inflation rate fell to 4% from a peak 12 months earlier of over 10% and is forecast to fall further over the next few months. As a result, UK interest rates, together with those of other European economies may be set to come down before those of the US. Such cuts, together with the Chancellor’s recent budget announcement regarding a ringfenced UK ISA, have the potential to reduce withdrawals from UK funds and could even bring in some new capital from overseas investors, if they start to recognise that the UK stock market, and UK small/micro-companies in particular, are standing on such low valuations.

We therefore believe that the potential of the UK stock market is much greater than appreciated, and that the best performing part of it could be UK-listed micro-companies. In time, even professional small company investors who have little micro-company exposure may find they need to participate, or else risk underperforming. Hence, we anticipate that UK micro-companies, when their recovery finally comes, might grow a lot faster than expected for a decade or more.

Gervais Williams & Martin Turner

Fund Managers, Miton UK MicroCap Trust