Premier Miton UK Value Opportunities Fund update

Matthew Tillett, fund manager of the Premier Miton UK Value Opportunities Fund, looks back over his first 12 months managing the fund.

For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

Is it Groundhog day?

It is November 2023, one year on from assuming the reins on the Premier Miton UK Value Opportunities Fund, and things feel eerily similar. Back in November 2022, a fragile global economy, in the process of absorbing a major shift in monetary policy, was causing heightened uncertainty in the financial markets. Time horizons had shortened and stock markets were in a febrile state, especially in the UK where the fallout from the failed Trussonomics experiment was still being felt. Vast valuation differentials between those companies seen as safe and reliable and those with any sort of cyclical risk profile – whether real or perceived – were the norm across the market.

But is there an exceptional opportunity ahead?

Looking into 2024 and beyond, we are of the view that the opportunity within UK equities today is as good as it has ever been. The reason is simple. Against the backdrop of a stock market that is being driven by macroeconomic fears and worries, bottom-up industry and company analysis is pointing to numerous fantastic investment opportunities across a range of sectors.

This is not to argue that “the macro” – inflation, interest rates, recessions etc – does not matter. Indeed, such risks should always be carefully considered in any investment analysis. But for stock pickers in today’s investment landscape, “the macro” is far from being the defining feature. To understand why, we need to go back to the pandemic, to see how this unprecedented event resulted in highly unusual and asynchronous cycles within different parts of the economy and the financial markets, which we are still experiencing today.

What began as a deep forced contraction in March 2020, was followed by a gigantic stimulus and a recovery that was far faster than expected, but only for certain industries and geographies that were allowed to reopen. Inability to satisfy demand and chronic supply chain constraints eventually culminated in high levels of inflation. This, in turn, led to a dramatic shift in the monetary policy cycle, with interest rates now at levels not seen since the mid-2000s. All of this means many industry cycles are in a very different position to where they would normally be at the top of a business cycle before a recession. Correctly understanding this is, we believe, the critical factor in assessing stock picking opportunities in the current environment. Here are some examples.

Autos – still recovering from the pandemic

The automotive industry, historically one of the most economically cyclical sub sectors, is nowhere near a cyclical peak in activity levels. Indeed, it could be argued that the opposite is the case. Chronic shortages of key components throughout the 2020-2022 period meant a significant under build of new cars relative to underlying demand. Because of this, new car registrations in most geographies are currently increasing but are still well down on 2019 levels, with a stock of pent-up demand still to satisfy as the recovery continues. S&P Global recently upgraded their forecasts for global automotive production, having made several upgrades over the course of 2023, but they still expect production to be well below the pre pandemic highs.

Yet stock market valuations for companies exposed to this industry, such as automotive suppliers, are mostly very low, implying a high risk of an imminent cyclical slow down. This likely reflects the perceived macroeconomic risk related to this sector. But with the industry volumes not far off the cyclical bottom, fundamental downside should be limited, and this therefore represents a very interesting contrarian opportunity.

This set up – an overarching macro bear case set against bottom-up industry fundamentals that tell a very different picture – can be found in many other areas. We are finding many similar investment opportunities in sectors such as aerospace, travel and real estate, where there are still powerful recoveries underway from the pandemic era.

UK consumer discretionary – already depressed?

Even amongst more obviously “cyclical” areas such as the UK consumer discretionary sector, the fundamental picture is far more nuanced than what is often implied by low stock market valuations. Whilst a recession scenario would be a headwind, it also important to keep in mind how far into the cyclical downturn certain categories already are.

Again, taking one of the most cyclical sub sectors as an example – in this case sofas – illustrates the point. According to DFS, the UK market leader with a near 40% UK market share, industry volumes over the 12 months to June 2023 were 15% lower than 2019, which was itself not a particularly elevated year by historical standards. And DFS is projecting another mid-single digit industry wide volume decline for the next 12 months, which would take the market over 20% down on 2019.

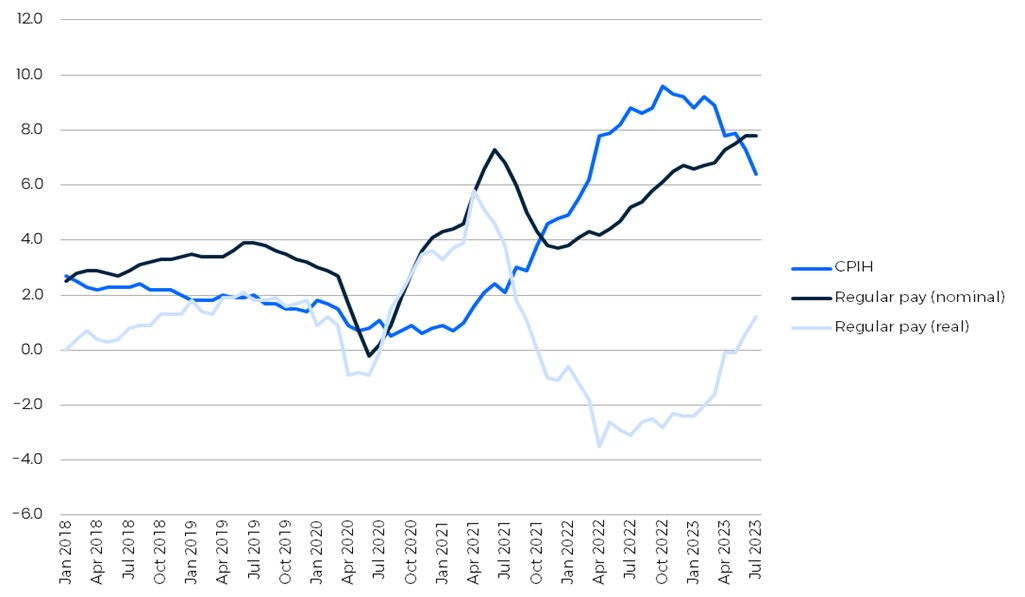

The culprit for this cyclical decline in volumes is the cost-of-living squeeze, which began back in early 2022. As the chart below shows, the most painful part of this episode was in 2022 when major costs such as energy and utilities were inflating rapidly, but wages were still stagnant. Encouragingly, this has now started to reverse as these costs have mostly stopped increasing (and some are declining), whilst wages have begun to catch up.

Real average weekly earnings single-month annual growth rates in Great Britain, seasonally adjusted, and CPIH annual rate, January 2001 to July 2023 %

Source: Numis, data from January 2018 to July 2023. CPIH stands for Consumer Prices Index including owner occupiers’ housing costs.

Real estate – as bad as it gets?

Perhaps the greatest surprise over the past 12 months has been the stubbornness with which longer term interest rates have risen and remained elevated relative to where they were in the 2010s. Initially this was explained by the surprising stickiness of inflation during the first half of 2023. More recently, as inflation has begun to decline but long-term interest rates have not fallen back, a “higher for longer” narrative has emerged, with some commentators citing ongoing fiscal largesse as the culprit. The biggest casualty of this development has been interest rate sensitive stocks, such as the listed real estate sector.

Contrary to the doom and gloom narrative that surrounds this sector, we are more optimistic and we have been increasing exposure in recent months. Very wide discounts to net asset values across most of the sector imply large and imminent falls in either rents, asset valuations or both. Yet in many real estate sub sectors, the outlook for rental growth is actually pretty good. Some sub sectors are benefiting from structural undersupply relative to demand, such as student property and logistics, which is a supportive backdrop for rental growth. More generally, it is only as leases gradually come up for renewal that the recent bout of inflation will feed its way into rental levels. Of course, this will take time, but it is a now a helpful ongoing tailwind for all but the most structurally challenged subsectors that lack pricing power.

All cycles are different

At this point, skeptical readers might be wondering whether all this is just another variation of the “this time it’s different” argument. Why over complicate matters? Don’t economically cyclical stocks always underperform in recessions? Well, actually this isn’t always the case. It is true that during the great recession of 2008-2009, cyclical stocks significantly underperformed defensives. But this was as much a result of the starting point as it was the effects of the recession itself. In 2007, almost everything in the economy was booming – consumer spending, consumer credit, financial leverage, corporate sector leverage, capital spending.

Meanwhile stock market valuations had compressed, with little difference between cyclicals and defensives, implying a low risk of a downturn was being priced in. So, when the recession hit, the repricing was swift and brutal.

But look back to the previous downturn, 1999 – 2003, and a very different picture emerges. At the peak of the stock market in 1999, valuation differentials within the market were far greater than they were in 2007, more akin to what we see in today’s market. The subsequent recession in the US caused a brutal bear market, but it was mostly driven by the highly valued parts of the market de-rating, such as technology and telecoms. The lowly valued out of favour old economy cyclical sectors performed surprisingly well during this period, despite this being a period of macro-economic weakness, including a recession in the US.

2024 – when “the micro” finally triumphs over “the macro”?

In conclusion, we are optimistic that 2024 may mark a welcome return to a market environment where the micro economic industry and company level drivers of the sort that we have highlighted in this note return to playing a greater role in driving share price outcomes. As every long-term investor knows, over the long term it is the bottom-up fundamentals, combined with the price that you pay, that ultimately drive returns. Get this analysis right and the outcome should be rewarding.

Yet sometimes the long term can seem like an awfully long way away, especially when markets are particularly focused on short term macro worries as they are now. But it is precisely during these times that the discrepancies between price and long-term value are often at their greatest, creating exceptional opportunities for contrarian minded long term investors.