Investors seem to be suffering a crisis of confidence in UK smaller companies, but is the asset class on the cusp of a renewed supercycle? Gervais Williams and Martin Turner, managers of The Diverse Income Trust plc, think it could be.

For information purposes only. Any views and opinions expressed here are those of the authors at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

The small cap effect

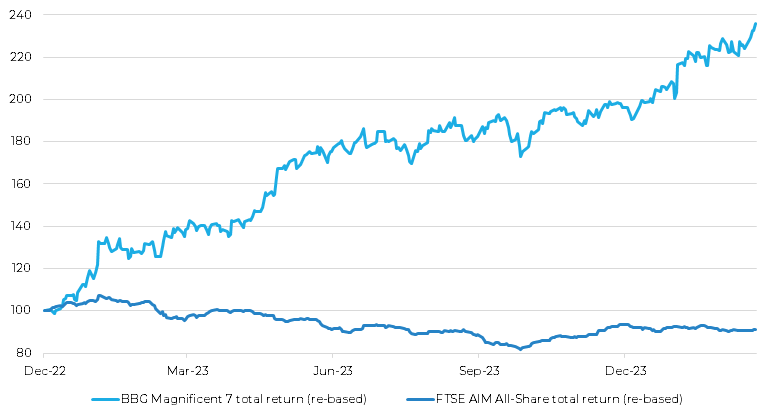

The small cap effect links the long-term return of an individual stock to the inverse of its market capitalisation. However, from a global perspective, over recent quarters market returns have been dominated by the outperformance of the US mega-cap stocks nicknamed “The Magnificent Seven”, (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). In 2023 this group delivered a collective total return of 96% in sterling terms. By comparison, the FTSE AIM All-Share Index fell by 6% (also in total return terms). Although the index started to recover in the final quarter of 2023, it was manifestly not a year for UK smaller companies.

Magnificent 7 vs the FTSE Aim All-Share Index

Source: Bloomberg 30.12.22 to 22.03.2024. Past performance is not a reliable indicator of future returns.

The benefits of income diversification

Against this background, we believe a key advantage of the Diverse Income Trust’s mix of holdings is that its stream of dividend income has greater growth potential than that of mainstream UK income stocks alone. Some portfolio holdings are mature but sit alongside others that are less mature. The sales and earnings of some are principally derived from overseas, while others are skewed domestically. Some are large companies while others are small companies.

Harnessing the smaller company effect via a multi-cap strategy offers the potential for the Trust’s portfolio income from dividends to grow at a faster rate than many of its peer group in the AIC UK Equity Income sector. We believe that premium growth in dividend income is linked with premium capital appreciation over the longer term..

Fluctuations in capital returns tend to attract most of the headlines, because changes in dividend prospects are gradual in comparison. But if premium revenue growth is linked to premium capital appreciation, it should offer some reassurance that the Trust’s recent capital underperformance is principally due to a devaluation of portfolio valuations rather than to a deterioration in ongoing dividend prospects.

Another characteristic of a multi-cap portfolio is that its returns are often less correlated to the fluctuations of the mainstream stock market indices, which we see as an advantage, therefore the net asset value of Diverse Income Trust may not move in line with its peers..

The wider market outlook

While we may now start to see gradual cuts in interest rates, if US growth remains relatively strong, we would not expect the US Federal Reserve to cut rates aggressively. Were economic growth to slow sharply however, more substantial interest rate cuts are possible, but could be accompanied by widespread profit and dividend downgrades.

Furthermore, as international trading relationships fragment, government policies have typically become more nationalistic in tone, and are often antagonistic to other nations, with the result that geopolitical tensions have increased. When global tensions spill over into armed conflict, this can precipitate a global economic setback.

Although for now investors seem generally upbeat that the global economy appears to have dodged a recession, and asset markets are appreciating, their trajectory looks quite uncertain for the remainder of 2024, and is liable to be marked by moments of elevated volatility. Either central banks will deliver fewer interest rate cuts than expected, or they will once more make a dash for near-zero interest rates and Quantitative Easing, irrespective of the associated inflationary risks.

Global growth…

One of the characteristics of globalisation has been a benign inflationary background. When share prices weakened during previous economic downturns, the absence of inflation permitted central banks to inject repeated financial stimulus, enhancing bond valuations, and often driving a simultaneous improvement in the valuation of global equity markets. Given rising valuations and near-continuous global economic expansion, the globalisation decades saw excellent asset returns with stock markets typically marked by moderate volatility. Whilst this outcome was welcome, we would point out that at other times asset market trends and hence the optimal investment strategy can be very different.

…or its absence

In the absence of ongoing global growth, larger companies with dominant market positions may struggle, as big companies are less able to make up for a demand shortfall by expanding rapidly into other areas. By contrast, small caps, with their greater agility, may be able to more than make up for a setback by participating in a favourable trend elsewhere.

When combined with inflationary pressures, supply within capital-intensive industries may become inelastic, due to inflated build costs and the higher rates of return required. Capital-intensive sectors that do experience demand may deliver quite exceptional returns on their operational assets during these periods as a result.

In our view, economic and geopolitical trends are becoming fundamentally unsettled. Global growth potential may be compromised, and inflationary pressures may hover in the wings. UK listed capital-intensive stocks have the potential to surprise on the upside, as when they significantly outperformed US stocks between 1965 and 1985, a period of inflationary pressures and recession. Importantly, UK-quoted small caps were the best performing part of one of the best performing stock markets during this time.

What does this mean for the Diverse Income Trust?

With many of the Trust’s portfolio holdings standing on overlooked valuations, they are ripe for performance catch-up. If the global economy were to remain stable, there is scope for UK small cap share prices to stage a major recovery.

If there were a crisis however, and central banks were obliged to revert to zero-interest rates and QE, then once the dust had settled, there would be even greater scope for the Trust to outperform. Whilst high-beta stocks might outperform in the initial phase, we assume that a return of inflation would favour the UK stock market as it did during 2022 given the capital-intensive nature of many of its mainstream stocks. This time however, we believe investors would have learnt about the UK’s potential for outperformance. We also anticipate that UK small caps would outperform these mainstream stocks and thus become one of the best performing assets in global terms.

Few local investors are currently prepared to contemplate that such an outcome is even possible, but for us, the bottom line is that UK-quoted small-caps may be set for an imminent supercycle.